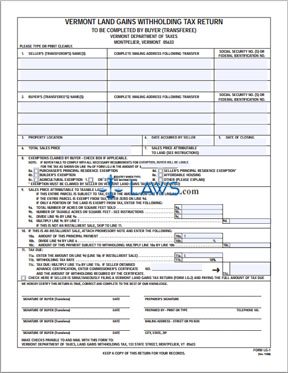

vermont state tax form

B-2 Notice of Change. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes.

Government Of Vermont Wikipedia

Details on how to only.

. Vermont Income Tax Forms. The IN-151 form is used for Vermont residents who seek an extension of the filing deadline for their state income tax returns. Form 1095-B is your proof of qualifying health coverage for each month you had it during the.

TaxFormFinder provides printable PDF copies of 52 current. Tax Year 2021 Form WHT-436 Quarterly Withholding Reconciliation and HC-1 Health Care Contributions Worksheet. Printable Vermont state tax forms for the 2021 tax year.

Vermont Form IN-152 - Vermont Underpayment Estimated Individual Income Tax. You are required to select the type of ownership. Estate Tax Return - death occurring before or on Dec.

IN-111 Vermont Income Tax Return. Vermont state income tax Form IN-111 must be postmarked by April 18 2022 in order to avoid penalties and late fees. 31 2022 can be e-Filed along with an IRS Income Tax Return by the April 18 2023 due date.

Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment. All Forms and Instructions. Vermont State Income Tax Return forms for Tax Year 2022 Jan.

Income Tax Instructions - Income Tax Instructional Booklet. The 1099-G is a tax form for certain government payments. Fact Sheets and Guides.

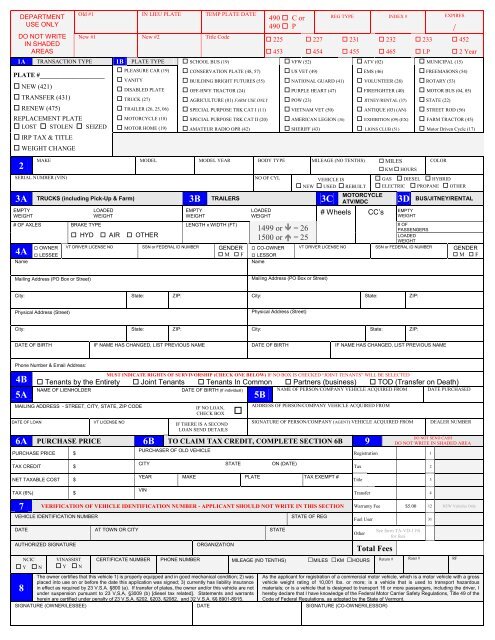

Vermont State Income Tax Forms for Tax Year 2021 Jan. A manual of Vermont Apportioned Registration Plan IRP International Fuel Tax Agreement IFTA information. The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more about vehicle taxation.

E-2A 2020 Instructions 2020 Vermont Estate Tax Information And Application For Tax Clearances. Vermont Form IN-151 - Vermont Application for Extension of Time to File Individual Income Tax Return. 802 828-2515 or 855 297-5600 Fax.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. This booklet contains information on how to fill out and file your income taxes for Vermont. Vermont has a state income tax that ranges between 3350 and 8750.

By Telephone or Fax. Successfully filing the IN-151 automatically allows Vermont. If you file a tax extension.

The instructions cover how to complete. IRS Form W-9 Use Form W-9 to provide your correct Taxpayer Identification. If you file Vermont state taxes you will need to report the months that you had health coverage.

Complete the online order form or select one of the ordering options listed below.

Free Form In 151 Application For Extension Of Time To File Individual Income Tax Return 2011 Free Legal Forms Laws Com

Vermont Tax Commissioner Reminds Vermonters To Pay Use Tax Vermont Business Magazine

State W 4 Form Detailed Withholding Forms By State Chart

How To File And Pay Sales Tax In Vermont Taxvalet

What Is A W 9 Tax Form H R Block

Vermont Estate Tax Return State Of Vermont State Vt Fill And Sign Printable Template Online

Form W 4vt 2021 Fill Online Printable Fillable Blank Pdffiller

Tax Dept Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Vermont Business Magazine

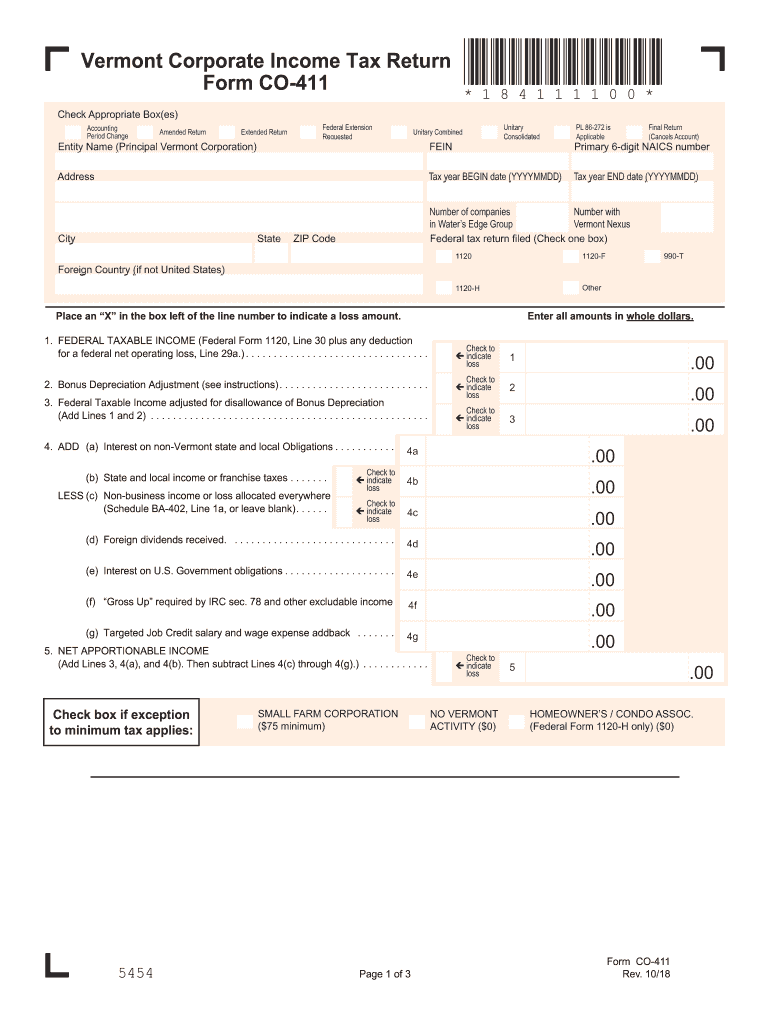

Vt Co 411 Fill Out Sign Online Dochub

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Homestead Property Tax Archives Vtdigger

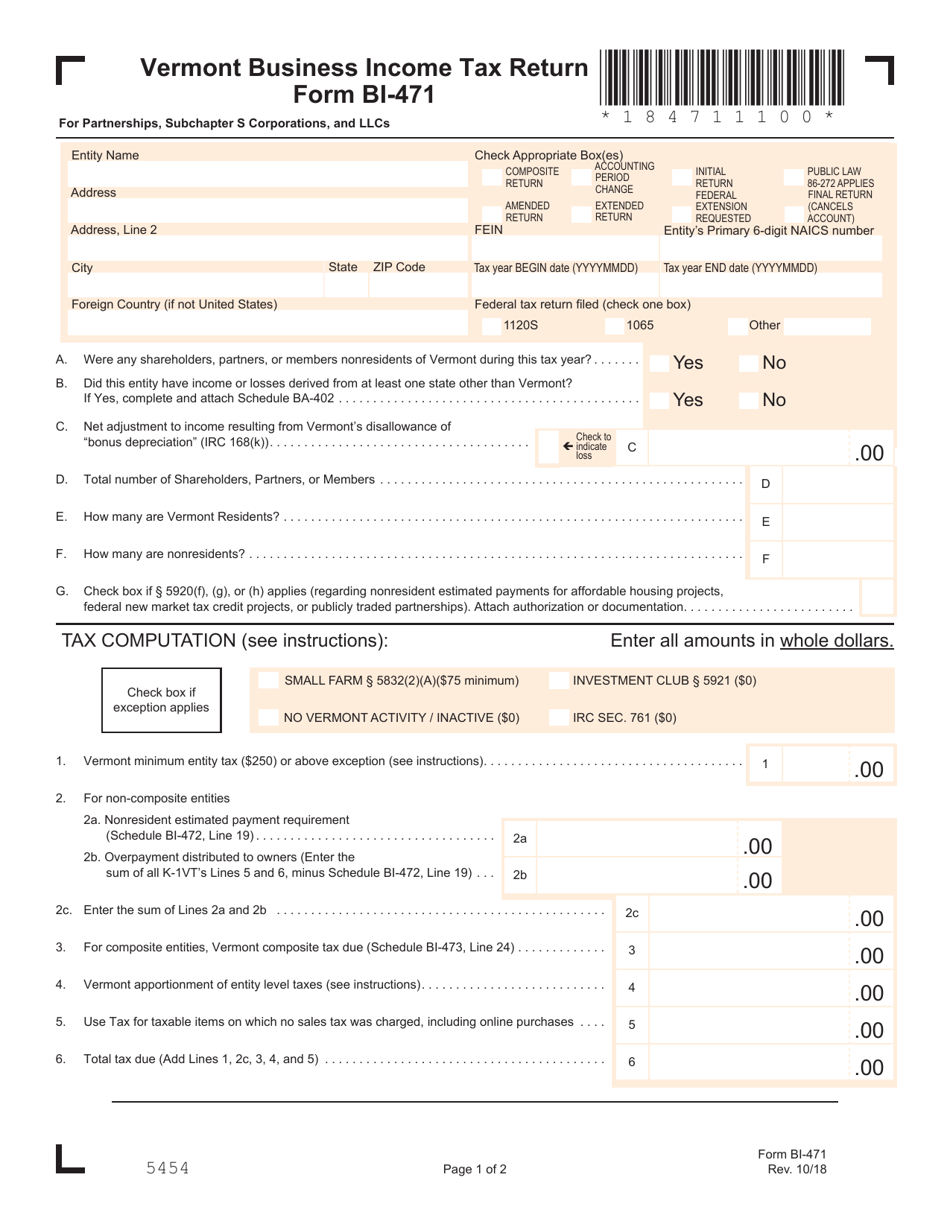

How To Start An Llc In Vermont For 49 Vt Llc Formation Zenbusiness Inc

Registration Tax Title Application Vermont Department Of Motor

Property Tax Flyer Halifax Vermont Halifax Vermont Halifax Vermont

Vermont Department Of Taxes Need A Vermont Income Tax Booklet Including Forms Stop By 133 State Street In Montpelier Go Around The Back Of The Building And Take One From The

Vt Form Bi 471 Download Printable Pdf Or Fill Online Business Income Tax Return Vermont Templateroller